|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding FHA 95 Cash Out Refinance Options and ConsiderationsThe FHA 95 cash out refinance is a financial tool available to homeowners, allowing them to refinance their existing mortgage and access cash. This option can be particularly appealing for those who have built up significant equity in their homes and wish to leverage it for various financial needs. Benefits of FHA 95 Cash Out RefinanceOne of the primary advantages of this refinancing option is the ability to access up to 95% of your home's current value. This can provide a substantial amount of cash for major expenses, such as home renovations, paying off high-interest debt, or funding educational pursuits.

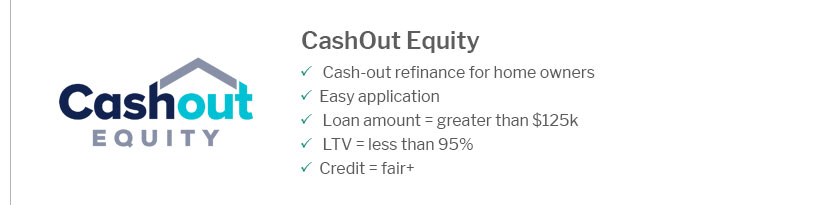

Eligibility CriteriaCredit Score RequirementsWhile FHA loans are known for their flexibility, there are still minimum credit score requirements to qualify for an FHA 95 cash out refinance. Generally, a score of 620 or higher is preferred, although some lenders may have their own criteria. Home Equity and Loan LimitsTo qualify, homeowners must have sufficient equity in their property. Additionally, there are FHA-imposed loan limits that vary by location, which can affect the amount you can refinance. It's important to use tools like calculate my refinance mortgage payment to understand potential outcomes. Potential DrawbacksWhile the FHA 95 cash out refinance offers numerous benefits, there are also some potential downsides. Understanding these can help in making an informed decision.

FAQWhat is the difference between FHA cash out refinance and conventional cash out refinance?The primary difference lies in the loan-to-value ratio and credit requirements. FHA cash out refinance allows for a higher LTV ratio and typically has more flexible credit requirements compared to conventional options. Can I use an FHA 95 cash out refinance for investment purposes?No, FHA cash out refinance is intended for owner-occupied properties only and cannot be used for purchasing investment properties. How do I apply for an FHA 95 cash out refinance?To apply, you should contact an FHA-approved lender who can guide you through the process, assess your eligibility, and help you gather necessary documentation. For more insights, you might consider visiting forums for better mortgage refinance reviews reddit, where real users share their experiences and advice on refinancing options. https://marqueemortgagellc.com/financing/fha-refinance/

The FHA cash out refinance is for homeownersthat are looking to refinance their existing mortgage while also converting some of the existing equity in the home ... https://www.fha.com/fha_article?id=2783

In 2009, the government's response to the housing crisis included lowering the LTV on FHA cash-out refinance loans down from 95% to 85%. The revised LTV of 80% ... https://moreirateam.com/mortgage-products/fha-cash-out-refinance/

Before April 1, 2009, the FHA allowed a 95% maximum cash-out refinance. The LTV limit was then reduced to 85%. On September 1, 2019, the FHA reduced again down ...

|

|---|